- Author Matthew Elmers [email protected].

- Public 2023-12-16 21:49.

- Last modified 2025-01-24 09:17.

On March 11, 2019, the authoritative Stockholm International Peace Research Institute (SIPRI) published a regular report, which the institute prepares every five years. The report discloses information on the volume of deliveries of the main types of conventional weapons in the period from 2014 to 2018 inclusive. According to researchers, over the past five years, the volume of international supplies of conventional weapons has increased by 7.8 percent (compared with the figures for 2009-2013). At the same time, the report notes an increase in the volume of supplies of American weapons and a drop in the volume of supplies of weapons from Russia over the specified period by 17 percent.

The report states that the gap between the United States and other arms exporters is becoming more serious. Thus, over the past five years, the export of American weapons has grown by 29 percent compared with the figures for 2009-2013. The share of states in the total volume of world arms supplies rose from 30 percent to 36 percent. The United States has further strengthened its position as a leading international arms supplier in recent years, according to Dr. During this period, states delivered weapons to 98 different countries. At the same time, SIPRI points out that the export of Russian arms has decreased over the past five years by 17 percent compared to the figures for 2009-2013.

The decrease in the volume of supplies is associated primarily with a decrease in the import of Russian weapons to two countries - Venezuela and India. These two states have seriously reduced their arms purchases. So in Venezuela, for obvious reasons (the country is in the deepest social, economic and political crisis), arms imports in 2014-2018 decreased by 83 percent at once compared to 2009-2013. India's arms imports did not fall that much - by 24 percent in 2014-2018. But such a drop appears to be serious, since during this period, arms imports from Russia accounted for 58 percent of all Indian arms imports. Naturally, such dynamics could not but affect the indicators of Russian arms exports. At the same time, the growth in the supply of American weapons is explained by the appetites of Saudi Arabia, which increased the volume of imports of weapons by 192 percent at once, becoming the world's largest importer of weapons. Also, the successes of the Americans are associated with Australia, which has become the 4th largest importer of weapons in the world, increasing purchases in this area by 37 percent. This is largely due to Australia's renewal of its aircraft fleet. The country has purchased 50 F-35A fifth-generation multi-role fighters from the United States to replace Australia's outdated F-18 Hornet fighters. The cost of this transaction alone is estimated by experts at $ 17 billion.

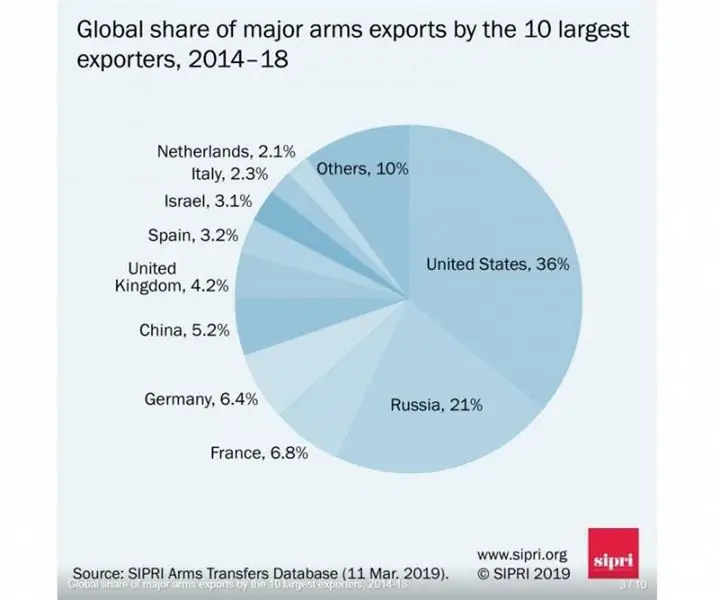

In general, the situation with the export of arms in the world has not undergone significant changes, the five leading exporting countries have remained unchanged. The five major arms exporters account for more than 75 percent of the total supply. In 2014-2018, the top five arms exporters were as follows: the United States (36 percent), Russia (21 percent), France (6.8 percent), Germany (6.4 percent), China (5.2 percent).

It should be noted that in Russia any information related to the export of arms is perceived sharply. And there is an explanation for this. Today the export of arms is one of the calling cards of our country, Russian weapons are known all over the world. At the same time, the supply of weapons is not only international prestige, but also serious financial injections into the Russian economy. In the structure of Russian exports, the lion's share is made up of deliveries of fuel and energy products, while their share has been constantly growing in recent years, exceeding 60 percent in the structure of exports. Another 10 percent comes from supplies of metals and metal products. Approximately equal volumes are accounted for by the products of the chemical industry and the supply of machinery and equipment, which also account for about 6 percent of Russian exports. Of these 6 percent, at least two-thirds falls on military products.

It would seem that the share is not so significant. However, it is very important, since today weapons and military equipment are, by far, the most high-tech item of Russian export on the international market. Russian weapons are traditionally high-tech products with high added value. Moreover, it directly competes with similar products manufactured by highly developed countries with strong economies and looks quite convincing in this competition.

SAM S-400 "Triumph"

And here we go back to the beginning of our article and the published SIPRI study. Is Russia really losing its position on the international arms market? The answer is that it doesn't lose rather than loses. How the report prepared by the Stockholm International Peace Research Institute is prepared is of paramount importance. In the explanation to it, it is written in black and white that this study reflects the volume of arms shipments (including sales, military assistance, and licenses for the production of military products), but does not reflect the financial value of the transactions concluded. Since the volume of supplies of weapons and military equipment can fluctuate from year to year, the institute submits reports for a five-year period, which allows for a more balanced analysis.

Here we come to the main point. In value terms, Russian arms exports did not subside. In recent years, our country has annually concluded contracts in the defense sector for about $ 15 billion. The number of contracts under the Rosoboronexport line has changed very little over the past three years, the achieved result is being maintained, however, there is no significant growth yet. The portfolio of contracts concluded by Rosoboronexport exceeds $ 50 billion with a term of 3-7 years, which provides the enterprises of the Russian defense industry with work.

In this regard, no drawdowns have been observed in the export of Russian arms. The problem is in the methodology of the SIPRI institution itself, which does not record the financial value of the concluded transactions. As an illustrative example, we can give a comparison: Russia can supply a foreign customer with 6-8 divisions of S-300 air defense systems or 2 divisions of S-400 Triumph air defense systems. The cost of the transaction will be comparable, and the volume of supplies will differ significantly. The same applies to main battle tanks, it is one thing to supply the customer with the latest and most modern serial Russian T-90MS tank at the moment, or take 10 T-72 tanks of the first series from army storage bases. Financially, it will probably be the same amount, but it is impossible to compare them qualitatively.

Multipurpose fighter Su-35

At the same time, the same S-400 Triumph anti-aircraft missile system is currently the locomotive of the Russian defense industry and the most successful product in the Russian defense portfolio. The deliveries of this system to foreign customers more than cover the losses from the termination of the supply of military products to Venezuela, which in the foreseeable future will not be able to buy any modern weapons, not only Russian-made, but also anyone else's. The buyers of the new Russian anti-aircraft missile system have already become Turkey (the deal is worth more than $ 2 billion), China (the deal is estimated at over $ 3 billion) and India, which is ready to purchase 5 regimental kits at once (the deal is estimated at over $ 5 billion) … At the same time, India signed the contract, even despite the threat of US sanctions. According to the American channel CNBC, which referred to its sources in American intelligence, at least 13 states are showing interest in the Russian S-400 air defense system, primarily the countries located on the Arabian Peninsula, North Africa and Southeast Asia.

True, American sanctions in the long term can really make the life of the enterprises of the Russian defense industry more difficult. So Russian manufacturers of cartridges are already suffering losses from the sanctions, losing about 10 billion rubles of their revenue a year. Before the sanctions, 80 percent of Russian products went to American and European markets where civilian weapons were allowed. In the United States alone, more than 390 million units of firearms are in the hands of the population; the loss of this market was a painful blow to Russian cartridge factories.

Another most famous swallow of sanctions pressure was the pending contract for the supply of T-90MS and T-90MSK tanks (command version) to Kuwait. This state was supposed to become a starting customer for new Russian main battle tanks, prototypes of which were tested in the Kuwait desert back in 2014. According to the information disclosed by Uralvagonzavod, the completion of the contract for the supply of 146 main battle tanks T-90MS / MSK to Kuwait was listed among the priority areas of the company's military-technical cooperation for 2017. At the same time, Kuwaiti officials emphasize that this contract has not been terminated, but has been temporarily postponed. According to unofficial information, the contract was suspended directly under US pressure on the Kuwaiti authorities, which is so far the most notable result of US sanctions pressure aimed at military-technical cooperation between Russia and foreign customers after the adoption of the CAATSA (Countering America's Adversaries through sanctions ).

Main battle tank T-90MS

At the same time, such pressure on the main buyers of Russian weapons seems simply impossible. Secondary sanctions do not block the prospects for cooperation with Russia in the military-technical sphere for states such as India and China. Even US allies, such as Saudi Arabia, show an open interest in Russian weapons and can ignore the possibility of secondary sanctions, playing with the United States in the economic sphere on an almost equal footing. And for the developing countries of Africa or Southeast Asia, the abandonment of Russian weapons and components will mean the degradation of their armed forces, which is also unacceptable for them. And Russia itself, together with its partners, is looking for ways to circumvent the sanctions, in particular, using settlements in national currencies or such an exotic option as with Indonesia, where barter was included in the sale of multifunctional Su-35 fighters in the form of transferring a certain nomenclature of exchange goods. In short, it is still premature to say that Russia is losing its position on the international arms market, especially considering the financial aspect of the deals being made.